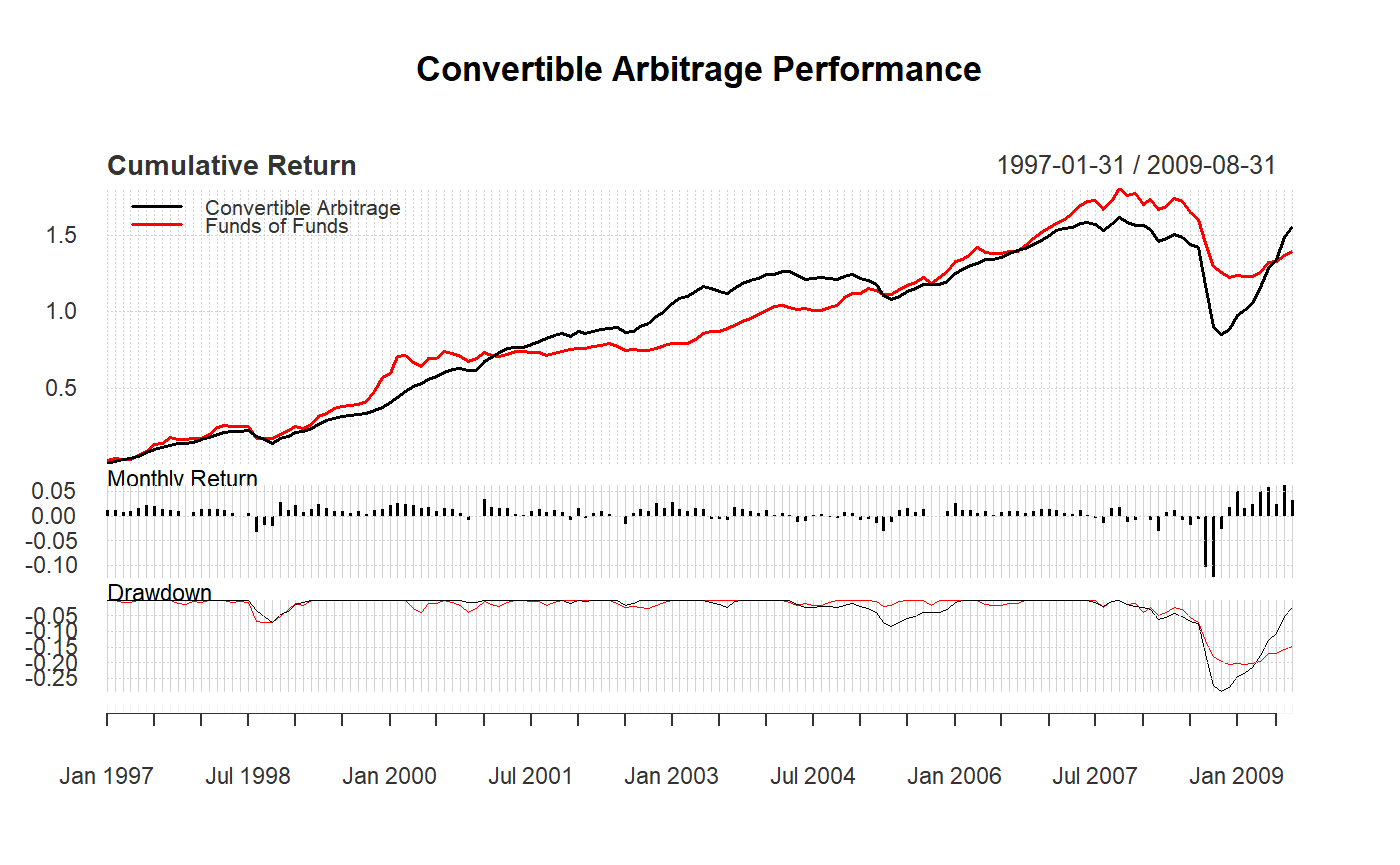

Create combined wealth index, period performance, and drawdown chart

For a set of returns, create a wealth index chart, bars for per-period performance, and underwater chart for drawdown.

charts.PerformanceSummary(R, Rf = 0, main = NULL, geometric = TRUE, methods = "none", width = 0, event.labels = NULL, ylog = FALSE, wealth.index = FALSE, gap = 12, begin = c("first", "axis"), legend.loc = "topleft", p = 0.95, ...)

Arguments

| R | an xts, vector, matrix, data frame, timeSeries or zoo object of asset returns |

|---|---|

| Rf | risk free rate, in same period as your returns |

| main | set the chart title, as in |

| geometric | utilize geometric chaining (TRUE) or simple/arithmetic chaining (FALSE) to aggregate returns, default TRUE |

| methods | Used to select the risk parameter of trailing

|

| width | number of periods to apply rolling function window over |

| event.labels | TRUE/FALSE whether or not to display lines and labels for historical market shock events |

| ylog | TRUE/FALSE set the y-axis to logarithmic scale, similar to

|

| wealth.index | if |

| gap | numeric number of periods from start of series to use to train risk calculation |

| begin | Align shorter series to:

passthru to

|

| legend.loc | sets the legend location in the top chart. Can be set to NULL or nine locations on the chart: bottomright, bottom, bottomleft, left, topleft, top, topright, right, or center. |

| p | confidence level for calculation, default p=.95 |

| … | any other passthru parameters |

Note

Most inputs are the same as "plot" and are principally

included so that some sensible defaults could be set.

See also

chart.CumReturns chart.BarVaR

chart.Drawdown

Examples

data(edhec) charts.PerformanceSummary(edhec[,c(1,13)])