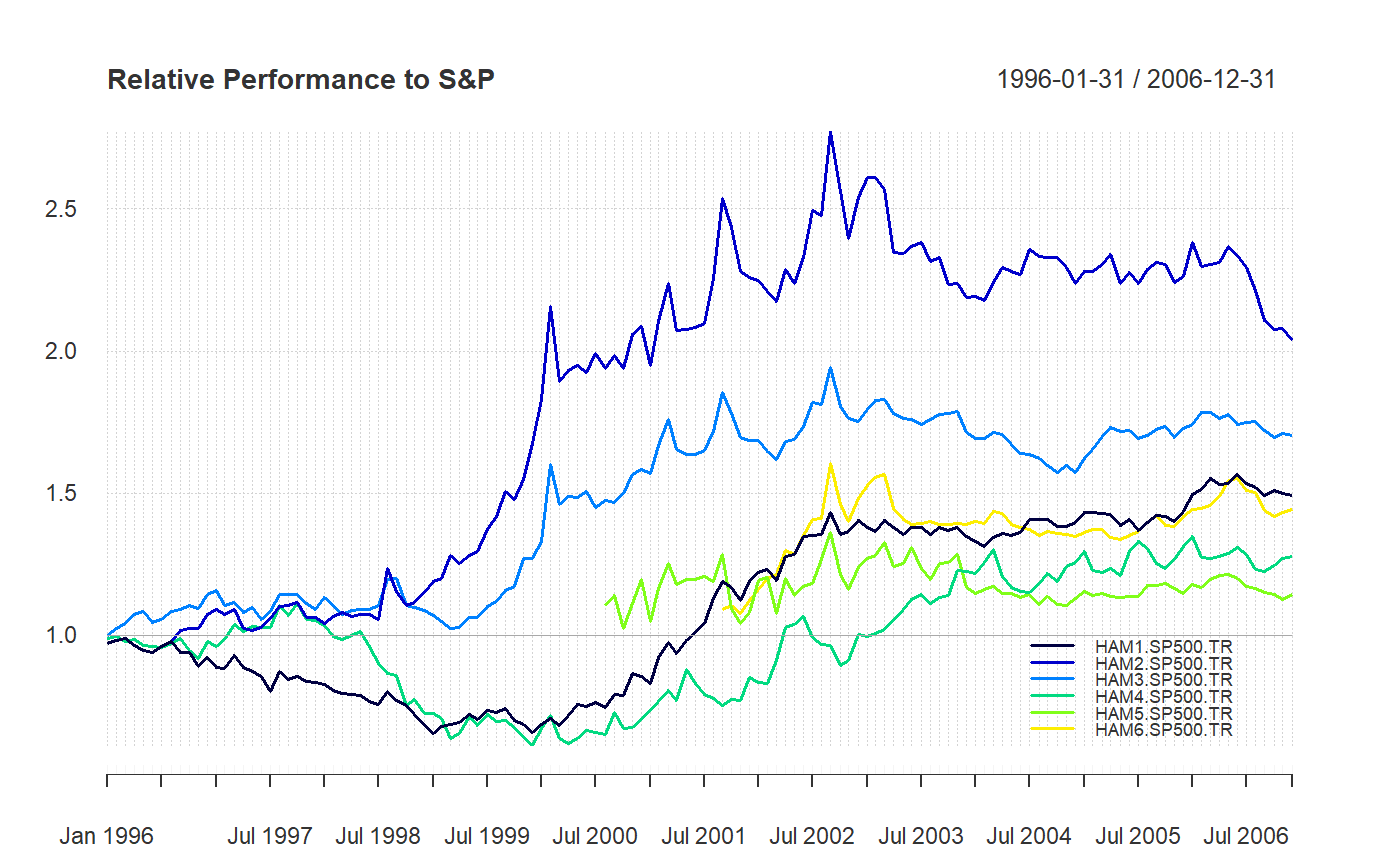

relative performance chart between multiple return series

Plots a time series chart that shows the ratio of the cumulative performance for two assets at each point in time and makes periods of under- or out-performance easier to see.

chart.RelativePerformance(Ra, Rb, main = "Relative Performance", xaxis = TRUE, colorset = (1:12), legend.loc = NULL, ylog = FALSE, elementcolor = "darkgray", lty = 1, cex.legend = 0.7, ...)

Arguments

| Ra | an xts, vector, matrix, data frame, timeSeries or zoo object of asset returns |

|---|---|

| Rb | return vector of the benchmark asset |

| main | set the chart title, same as in |

| xaxis | if true, draws the x axis |

| colorset | color palette to use, set by default to rational choices |

| legend.loc | places a legend into one of nine locations on the chart: bottomright, bottom, bottomleft, left, topleft, top, topright, right, or center. |

| ylog | TRUE/FALSE set the y-axis to logarithmic scale, similar to

|

| elementcolor | provides the color for drawing less-important chart

elements, such as the box lines, axis lines, etc. replaces |

| lty | set the line type, same as in |

| cex.legend | the magnification to be used for sizing the legend relative to the current setting of 'cex'. |

| … | any other passthru parameters |

Details

To show under- and out-performance through different periods of time, a time series view is more helpful. The value of the chart is less important than the slope of the line. If the slope is positive, the first asset (numerator) is outperforming the second, and vice versa. May be used to look at the returns of a fund relative to each member of the peer group and the peer group index. Alternatively, it might be used to assess the peers individually against an asset class or peer group index.

See also

Examples

data(managers) chart.RelativePerformance(managers[, 1:6, drop=FALSE], managers[, 8, drop=FALSE], colorset=rich8equal, legend.loc="bottomright", main="Relative Performance to S&P")